To perform this HR-related task, you must first Navigate to the HCM Self Service Homepages.

Viewing Paycheck (Earnings Statement)

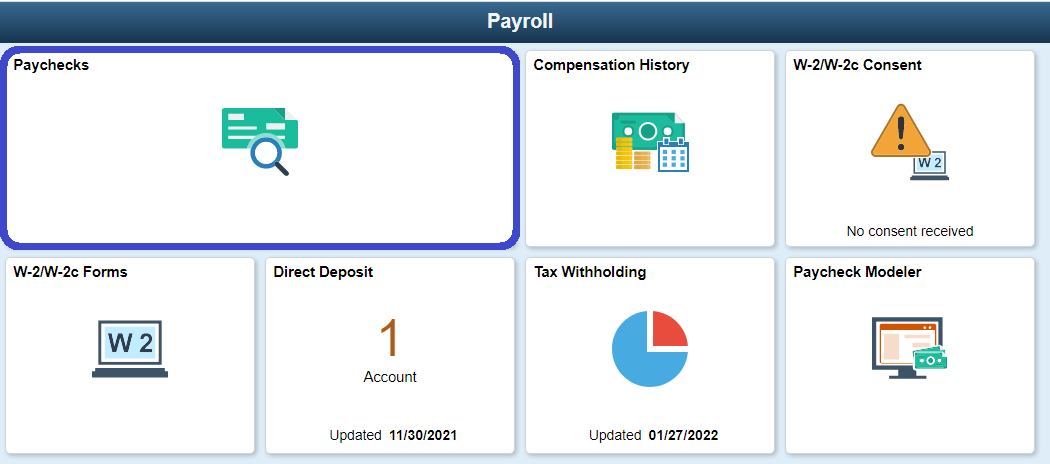

1. On the Employee Self-Service homepage, click on the Payroll Tile.

2. On the Payroll page, click on the Paychecks Tile.

3. Select the paycheck you want to view. A PDF of your paystub will open in another window. An example of a Direct Deposit PDF is shown below; a list of labeled sections and descriptions follow. NOTE: Earnings statement may look different on your own statement depending on employee deductions, benefit enrollments chosen, etc.

Numbered Sections and Descriptions from Direct Deposit Example

1. Pay Information including Employee pay group assignment and pay period dates.

2. Pay Information:

- Business Unit (college number)

- Check number and issue date

3. Employee demographics (home/mailing address, etc.)

4. Employee Information:

- Empl ID

- Job Title and Pay Rate

5. Tax Data including marital status and allowances

6. Hours and Earnings (Current and Year to Date; includes totals):

- Description of hours

- Rate

- Hours

- Earnings

7. Taxes (Current and Year to Date; includes totals):

- Federal Withholding

- Fed MED/EE

- Fed OASDI/EE

8. Before Tax Deductions (Current and Year to Date; includes totals). For benefit-eligible employee who elected to enroll in the respective benefit plans, the deductions below may be displayed:

- Uniform Classic

- Flexible Spending Account

- PERS Plan 2

9. After Tax Deductions (Current and Year to Date; includes totals). For benefit eligible employee who elected to enroll in the respective benefit plans, the deductions below may be displayed:

- Long Term Disability, SBVIP Pre & After Tax, MetLife

- Combined Fund Drive (CFD)

- Medical Aid EE, Paid Medical Leave EE, Paid Family Leave EE

10. Employer Paid Benefits (Current and Year to Date). For benefit eligible employee who elected to enroll in the respective benefit plans, the deductions below may be displayed:

- PERS Plan 2

- Industrial Insurance ER, Medical Aid ER, and Paid Family & Medical Leave ER

- FSA Admin Fee and HCA Average Cost

11. Total Gross/Federal Taxable Gross/Total Taxes/Total Deductions/Net Pay

12. Summary Leave Balances (Displays most recent balances):

- Vac (Vacation)

- Sck (Sick)

- NSCK (Non comp sick leave)

- P/H (Personal Holiday)

- PERS (Personal Day)

- CMP (Compensation Time)

13. Net Pay Distribution (Includes total):

- Advice Number (for direct deposit)

- Account Type (checking or savings) and Account Number(s)

- Deposit Amount(s)

Human Resources Office

If you run into any issues following this guide, please contact the Human Resources Office to resolve them. We're open from 8 am to 5 pm weekdays:

- Call us at (360) 596-5500

- Email us at HumanResourcesStaff@spscc.edu

- Visit us in person in Building 25 Room 220